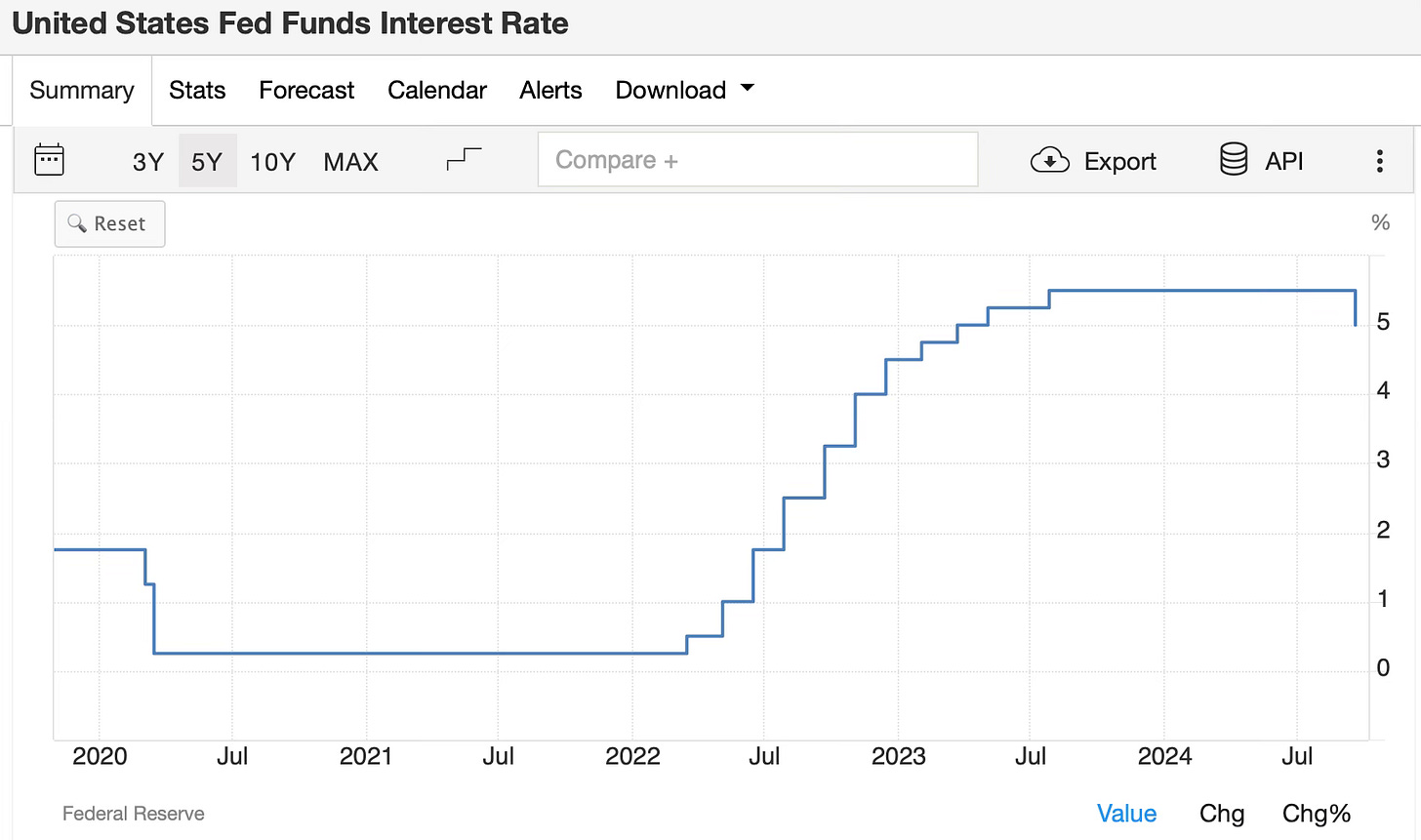

In September 2024, the Federal Reserve lowered its key interest rate by 0.50%, bringing it down to 4.75%-5%. This was the first time rates were cut since March 2020. Many experts expected a smaller reduction of 0.25%, but the larger cut is meant to help reduce borrowing costs.

The Fed also shared their outlook for the future. They plan to reduce rates by another 1% by the end of the year, likely through two more small cuts of 0.25%. In 2025, rates could go down another full percentage point, with one last cut in 2026.

For homeowners, this means lower interest rates could make it a good time to refinance, potentially saving money on your mortgage payments as rates come down. Whether you're seeking to improve cash flow or pay off your mortgage faster, here are 10 effective strategies to help you save when refinancing.

Shop Around for the Best Rates

Compare multiple lenders to find the lowest interest rate and the best refinancing terms. Even a small reduction in your interest rate can lead to significant savings over the life of the loan.Improve Your Credit Score

A higher credit score often results in better mortgage terms. Before refinancing, work to improve your credit by paying down debt, paying bills on time, and correcting any errors on your credit report.Negotiate Closing Costs

Closing costs can add up quickly. Ask your lender if they can reduce or waive some fees, or look for "no-closing-cost" refinancing options, though these may come with slightly higher interest rates.Shorten Your Loan Term

Refinancing into a shorter loan term (e.g., 15 or 20 years instead of 30) may come with lower interest rates. While your monthly payments might be higher, you’ll save a lot on interest over the life of the loan.Avoid Mortgage Insurance

If you have more than 20% equity in your home, you can likely avoid paying private mortgage insurance (PMI), which can save you hundreds of dollars per month.Lock In a Low Rate

If interest rates are low, locking in a rate early in the refinancing process can help you avoid potential rate hikes before closing.Consider a Cash-In Refinance

If you have extra cash available, a cash-in refinance allows you to pay down a chunk of your mortgage, increasing your equity and potentially qualifying you for a lower rate.Refinance at the Right Time

Keep an eye on market conditions. Refinancing when interest rates are low can help you lock in substantial savings. Avoid refinancing if you plan to sell the house in the near future, as the closing costs may outweigh the savings.Roll Fees into the Loan Carefully

You can roll your refinancing fees into your loan to avoid upfront costs. However, this can increase your loan balance, so be sure the savings on interest outweigh the increased loan amount.Consider Streamlined Refinancing Programs

Government-backed loans like FHA or VA loans often have streamlined refinancing options, which may allow you to reduce your interest rate with minimal paperwork and reduced fees.

By carefully considering each of these strategies, you can maximize your savings during the refinancing process.

thanks for the useful information.