6.2024 | Why buying property in a hot market after interest rates decrease could hurt.

Back in 2022 the interest rates for purchasing a residential property fluctuated around 3%. Most of the stories you hear from people buying at that time are positive and they feel lucky to avoid the increased rate hikes. However the dark side of low interest rates is something not many people have the chance to hear. Let’s look at an example of one of my listings for a condominium in downtown Bellevue.

I assisted my client in purchasing this new construction condo with 2 beds, 2 baths, 2 car garage, 1 den and a large balcony facing Mt. Rainier and the city. They held the property for a couple years and decided to sell. I brought the listing on market at an aggressive price, the highest the building had ever seen at the time. We scheduled an offer review date but got a full priced all cash offer with everything waived on day 3. The owners walked away with over 45% growth rate in 2 years and couldn’t be happier.

It is now 2024 and a lot has happened to the real estate market in the Seattle and Bellevue area. Interest rates increased almost 2x where they were in 2022 and the housing market took a substantial decline from that all time high. I researched the condo price as of 2024 and it has declined around 17% from our sold price, resulting in negative equity for the new buyers.

The Beta: how do you avoid overpaying in a hot market when interest rates are historically low?

Win the war without fighting.

Patience really pays when you wait for a property to go past it’s offer review date. Often times listing agents will price hot homes below market price in order to stimulate an escalation between buyers. This emotionally packed time frame causes some buyers to submit at their highest and best prices with everything waived. Instead of combatting in these situations it might be better to wait for homes that have gone past their offer review date. This allows you to take your time to do your research on the property and even potentially get your own inspector in before submitting an offer.Buy property directly from owners off market.

The hard part about this strategy is knowing how to find property owners that are ready to sell but haven’t listed their property on market yet. Some agents have a list of contacts in certain areas that they are preparing to list publicly but have not pulled the trigger yet. It’s worth asking your agent if they have any of these types of properties off market.

This strategy works very well because you do not have to compete with the open market for a property in a neighborhood that you prefer. Keep in mind that this strategy might require some extra work on your end after the property closes because the sellers might not have made it as presentable in comparison to listing it publicly. Finally, this strategy would require you to be a very proactive buyer and be preapproved with downpayment and earnest money ready.Submit early and give them an offer they can’t refuse.

This may sound like counter intuitive advice but if successful can save the buyer from competing in an escalation battle. I can tell you from experience that seller’s feel a sense of uncertainty whenever they list their home on the market. Sometimes a buyer can get a head start on the competition if they offer early and give the sellers an offer they can’t refuse. This doesn’t always mean an offer at the highest price. It sometimes means you can get away with something just slightly over list price but with great terms.

In conclusion:

When interest rates decrease in a hot market all the buyers and sellers waiting on the sidelines will flood back into the market. This may sound like a great thing but will create a level of competition that will exceed the expectations of 2022 market. Many buyers might find themselves escalating to levels far higher than what we are seeing today between 5-30% over list price. Their monthly mortgage may be lower but the amount they’d have to pay back to the bank could be extra daunting. Plus the buyers could face a negative equity situation if the market were to turn.

My suggestion to most buyers is to avoid timing the market. If they are financially ready now, it might be better to purchase now with a slightly higher monthly mortgage with the option to refinance lower later. Instead of over paying for a property that may never reach all time high prices again.

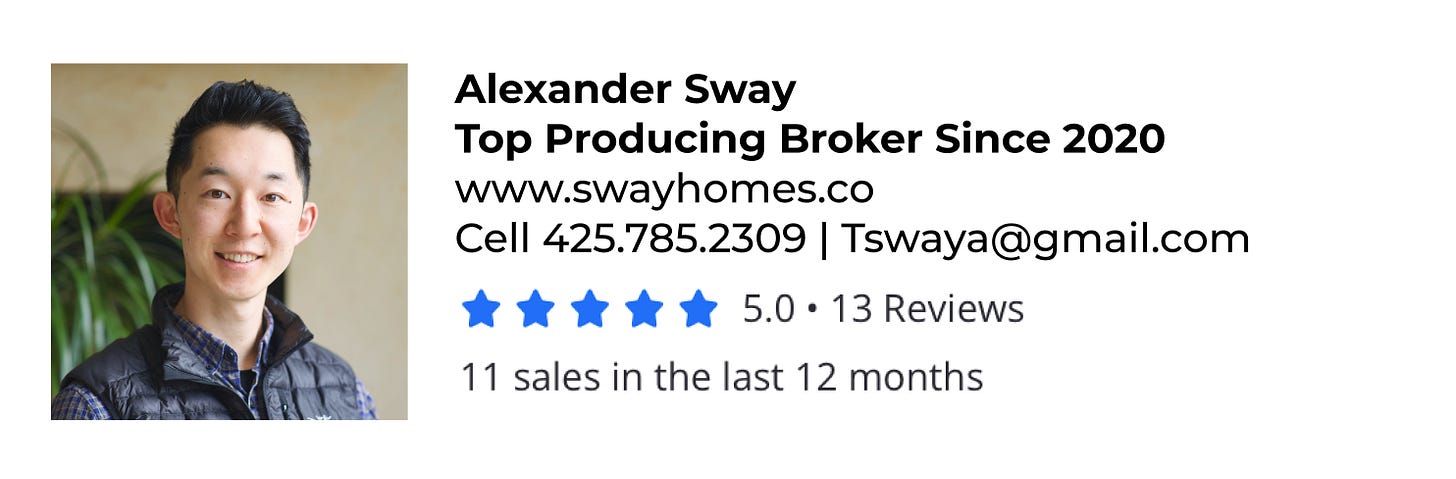

Thanks for reading and please feel free to reach out to me directly if you have any questions on listing your property for sale in the Washington state!